Prologue – Setting the Stage

In the dim glow of the backstage lounge, the four members of Rahab Punkaholic Girls lean around a small table littered with coffee cups, handwritten notes, and a laptop streaming the latest crypto news.

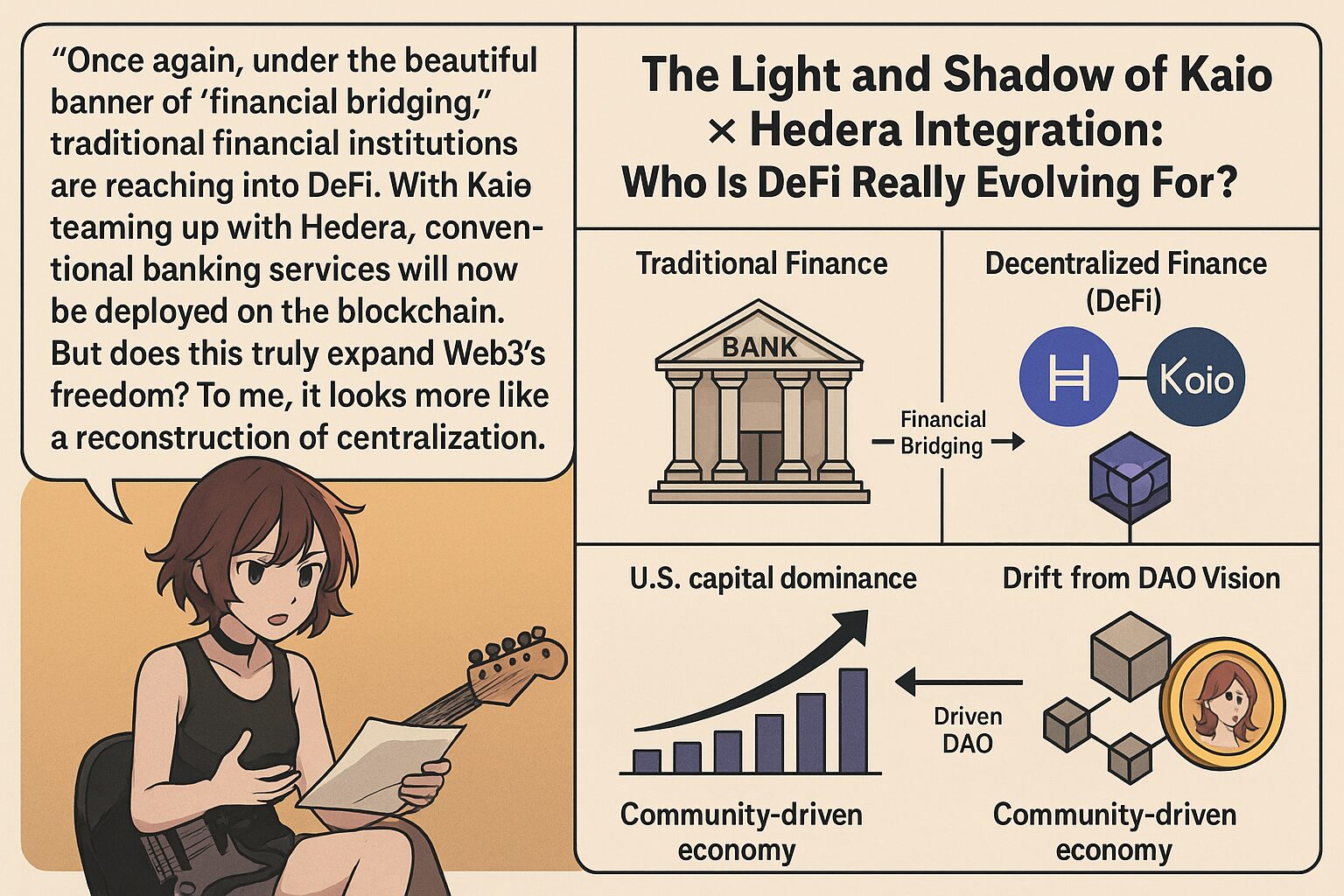

The headline flashes: “Kaio Bridges Traditional Finance and DeFi with Hedera Integration.”

For the mainstream press, this is a feel-good story: a seamless bridge between old money and new tech. For the band, veterans of the Web3 trenches, it triggers a different response—a mix of skepticism, frustration, and resolve.

Section 1 – Rahab (Vo): A Bridge or a Bottleneck?

“Once again, under the beautiful banner of ‘financial bridging,’ traditional financial institutions are reaching into DeFi. With Kaio teaming up with Hedera, conventional banking services will now be deployed on the blockchain. But does this truly expand Web3’s freedom? To me, it looks more like a reconstruction of centralization.”

Rahab leans forward, resting her elbow on her knee, voice cutting through the low hum of the backstage.

On the surface, Kaio’s partnership with Hedera promises a future where the silos of traditional finance and decentralized finance collapse into a single seamless experience. The integration could allow direct on-chain settlement for bank clients, faster fiat-to-crypto ramps, and potentially more secure custody solutions.

But Rahab’s eyes narrow. She’s seen this pattern before. Hedera, while technologically robust—boasting fast consensus times, low transaction costs, and a predictable fee model—is governed by a council of major corporations. Google, IBM, Boeing, and other global giants sit at the decision-making table.

“Decentralized in architecture doesn’t mean decentralized in control,” she says. “And that’s the trap.”

She recalls the early 2000s internet—once a wild frontier of open protocols and peer-to-peer exchange—gradually fenced off by corporate platforms that dictated the terms of engagement. The risk is history repeating itself under a shinier banner.

Rahab flips open her notebook, where she’s scribbled a reminder:

Web3 was meant to be borderless, permissionless, and community-governed—not an upgraded banking service wrapped in blockchain marketing.

A conceptual comparison across six axes between an ideal DAO and a TradFi-bridged DeFi stack (e.g., corporate-governed networks).

Section 2 – Moka (G/Vo): The Price of Convenience

“Yeah… for the average user, it might look ‘convenient.’ But doesn’t that convenience come at the cost of anonymity and autonomy? It reminds me of Howard Marks’ warning that ‘the most important thing is never to lose thoughtful vigilance.’ And isn’t this exactly one of those moments?”

Moka’s voice is softer but no less resolute. She has a knack for spotting the human cost beneath the technical specs.

Convenience, she explains, is a double-edged sword. Yes, Kaio’s Hedera integration could remove friction for everyday users: instant KYC-compliant onboarding, bank-grade custodial security, and regulatory clarity. But with each of those features comes a hidden trade-off—more personal data collected, more points of control reintroduced into systems meant to be trustless, and fewer ways to transact without corporate oversight.

She quotes Howard Marks from The Most Important Thing:

“You can’t predict the future, but you can prepare for it by being consistently thoughtful and avoiding complacency.”

For Moka, the creeping danger is not that Kaio and Hedera intend harm, but that users will stop asking the hard questions. In pursuit of ease, they may silently surrender the qualities—privacy, sovereignty, permissionless participation—that made DeFi revolutionary.

Her guitar rests against her knee as she says, almost in a whisper, “If the bridge is really a gated expressway with toll booths and checkpoints, is it still freedom?”

As convenience increases through compliance and custodial features, autonomy and privacy often compress. Conceptual allocation across five factors.

Section 3 – Rachel (Ba): Value vs. Price

Rachel strums her bass absentmindedly, letting a low hum fill the space before she speaks.

“There’s this line: ‘An investor’s job is to acquire suitable securities at suitable prices and hold them.’ It’s not just a finance textbook cliché—it’s survival advice. You’ve got to see the gap between value and price.”

She’s paraphrasing Benjamin Graham’s The Intelligent Investor, the book that drilled into generations of market participants the difference between market price—a creature of mood and momentum—and intrinsic value, rooted in fundamentals.

Hedera’s integration hype, Rachel notes, is all about the price: press releases, social buzz, potential token price spikes. But intrinsic value is about whether this move strengthens the decentralization, resilience, and community governance of the ecosystem. On that score, she’s skeptical.

“Hedera’s tech is solid, no doubt. But if the governance model depends on corporate approval, then no matter how fast or cheap the transactions, it’s not delivering the kind of sovereignty we’re fighting for.”

During headline events, “price” tends to spike while “intrinsic value” shifts gradually. A stylized event window.

Section 4 – John (Dr): A Counter-Strategy in PGirlsChain

John twirls a drumstick in his fingers before laying it flat on the table.

“U.S. capital is turning Web3 into a speculative playground. The original DAO vision was to transcend borders, to create seamless networks and empower communities. That’s why we run PGirlsChain and issue PGirls tokens—it’s our counterweight to this drift.”

He points to a hand-drawn network diagram pinned on the wall. PGirlsChain is a purpose-built blockchain where governance is open, nodes are geographically and organizationally diverse, and the PGirls token isn’t just for speculation—it’s the bloodstream of a creator-driven economy.

Unlike corporate-led integrations, PGirlsChain aligns token incentives with community benefit. Artists and fans transact directly, with smart contracts enforcing fair royalties, community treasuries funding collaborative projects, and governance votes open to all token holders without geographic bias.

“Kaio and Hedera can build their bridge,” John says, “but we’ll keep building roads that anyone can walk—no tolls, no checkpoints.”

Indicative governance weight across stakeholders inside PGirlsChain.

Epilogue – A Shared Resolution

Rahab:

“The bridge may look inviting, but history shows that tolls and checkpoints tend to appear later. We can’t afford to forget that.”

Moka:

“We need to keep asking whether convenience is worth the cost—especially when the cost is our own autonomy.”

Rachel:

“Price and value aren’t the same. Hype fades. What remains is the structure and the principles behind it.”

John:

“We have the tools to shape a different future. PGirlsChain is proof that a DAO-aligned network can thrive without leaning on the same old power structures.”

The conversation fades into the background hum of tuning instruments and the clink of coffee mugs.

The question of who DeFi is really evolving for isn’t abstract—it’s personal, and the answer depends on the choices made today.

Five key metrics where higher is better (except “Speculation Dependence (inverse)”, which is already inverted).

Tokens and benefits (access/experiences) circulate between Users, Creators, Validators, and the Community Treasury.