The Current State of Ethereum and the Market Environment

Ethereum’s Role and Position

Ethereum is the second-largest cryptocurrency by market cap and functions as a smart contract and decentralized application (DApp) platform. Originally proposed by Vitalik Buterin, it has revolutionized multiple industries including finance, gaming, law, and insurance through its programmable blockchain.

Current Price Trends

As of April 18, 2025, Ethereum is priced at $1,583.48, marking a 46.91% decline year-over-year. This trend has been influenced by U.S. monetary tightening, regulatory pressures from the SEC, and delays in ETF approvals. However, technical indicators are showing signs of a trend reversal.

Market Capitalization and Volume

Ethereum currently holds a market cap of approximately $180 billion, with a daily trading volume averaging $7 billion, securing its position as the foundational asset of the crypto market second only to Bitcoin.

Technical Indicators Suggesting a 35% Upside

MACD and RSI Signals

Ethereum’s MACD line has crossed above the signal line, forming a bullish crossover—a strong indicator of upward momentum. Additionally, the RSI has broken through a long-standing downtrend line, suggesting increasing buying pressure.

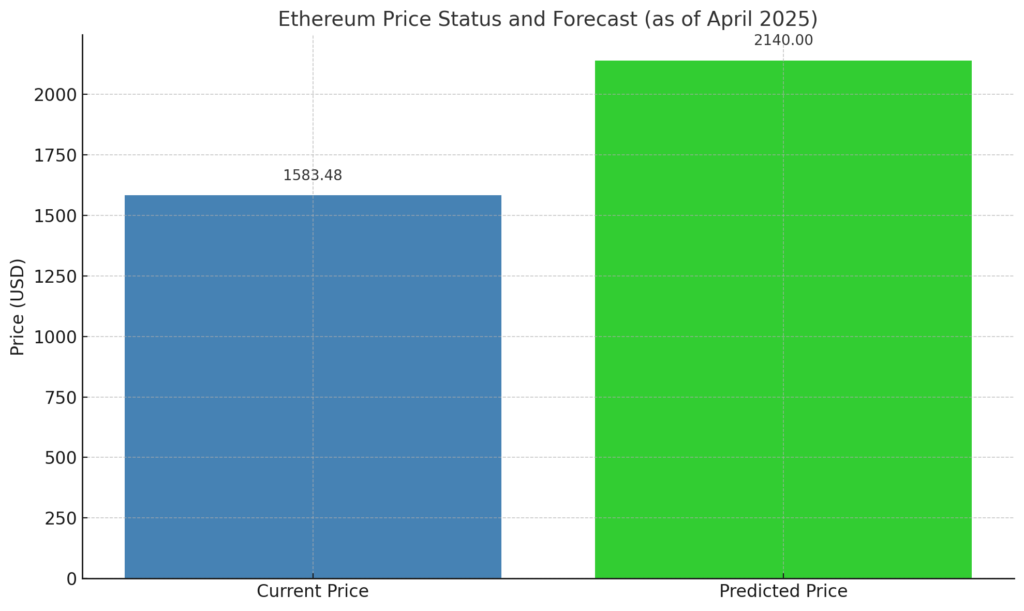

Calculated Price Target

Based on historical resistance zones and Fibonacci retracement levels, a projected target of $2,140 is identified—indicating a 35% potential upside from the current price.

Bollinger Bands and Volume

Bollinger Bands are transitioning from a contraction to an expansion phase, suggesting an impending breakout. Trading volumes are also increasing, hinting at growing institutional interest.

Illustration: Current and projected prices

Structural Shifts Driven by Ethereum’s Price Growth

Impact on the NFT Market

NFT platforms built on Ethereum (such as OpenSea and Blur) are seeing increased transaction volumes as price stability returns. NFTs, driven by scarcity, collectibility, and community interaction, remain popular among Millennials and Gen Z.

Revival of DeFi

A rising ETH price can reinvigorate the DeFi sector by boosting Total Value Locked (TVL) in major protocols like Uniswap, Aave, and Curve, improving yields in lending and liquidity mining markets.

Growth in GameFi and Metaverse

GameFi and metaverse platforms like The Sandbox and Decentraland benefit directly from Ethereum’s stability, enhancing Web3 entertainment and immersive digital economies.

Investor Strategies and Risk Management

Strategies for Short-Term Traders

Utilize technical signals to target profit-taking near $2,140. Suggested stop-loss level: $1,420. Consider swing trading within current volatility bands.

Long-Term Investment Outlook

Capitalize on Ethereum’s burn mechanism (EIP-1559) and staking rewards. Allocate 5–10% of your portfolio to ETH as a core holding with long-term upside potential.

Key Risks and Mitigation

- Security: Smart contract vulnerabilities

- Regulation: Evolving global policy frameworks

- Network Issues: Hard forks and critical bugs

Mitigation involves diversification and staying informed via trusted channels.

Ethereum’s Future and the Evolution of Crypto

Ethereum 2.0 and Scalability

With the complete transition to Proof of Stake and future implementation of sharding, Ethereum aims to drastically reduce gas fees and environmental impact.

Integration with Traditional Finance

Institutions like JPMorgan and Visa are testing Ethereum for cross-border payments and tokenization. Its presence in global finance is steadily growing.

Infrastructure for Web3

Ethereum is becoming the backbone of decentralized identities, DAOs, and social tokens—forming the foundation of the next-generation internet.

Key Takeaway (Conclusion)

True long-term investment is not about reacting to daily fluctuations, but recognizing and committing to technologies with lasting value and transformative potential. Ethereum is not just an asset—it is the infrastructure of a decentralized economy. Price movements are merely surface reflections of deeper structural influence.

In crypto, your greatest assets are “information” and “insight.”

コメント