🧠 Introduction: What is PSR and Why Does It Matter in NFTs?

In traditional finance, the Price-to-Sales Ratio (PSR) is a trusted metric used by value investors to assess how overvalued or undervalued a stock is relative to its revenue. In the same spirit, we apply PSR to NFTs:

PSR = Market Cap / 30-Day Sales Volume

A lower PSR suggests a project may be undervalued relative to its actual transactional activity—a hidden gem in the noisy world of NFT hype. Today, we rank the top 100 OpenSea NFT collections and highlight the 10 with the lowest PSR.

📊 PSR Ranking Methodology

- Source: OpenSea, snapshot taken on March 28, 2025

- Metric: 30-day PSR (Market Cap / 30-day Sales Volume)

- Focus: Top 10 lowest PSR projects (indicating potential undervaluation)

- Visuals: PSR trendlines, scatter plot, ranking table

🔝 Top 10 Undervalued NFT Projects (Based on PSR)

| Project | Symbol | Market Cap | Sales (7d) | Avg Price (7d) | Volume (7d) | PSR (7d) | Sales (30d) | Avg Price (30d) | Volume (30d) | PSR (30d) |

|---|---|---|---|---|---|---|---|---|---|---|

| Courtyard.io | ETH | 4174.53 | 80336 | 0.03139 | 2521.75 | 0.39 | 355891 | 0.03376 | 12014.88 | 0.35 |

| Azuki Elementals | ETH | 5179.49 | 960 | 0.29421 | 282.44 | 4.28 | 2643 | 0.33916 | 896.40 | 5.78 |

| Gemesis | ETH | 3572.87 | 1271 | 0.03771 | 47.93 | 17.39 | 14645 | 0.04131 | 604.98 | 5.91 |

| Memeland Captainz | ETH | 7967.10 | 434 | 0.79679 | 345.81 | 5.38 | 1494 | 0.88805 | 1326.75 | 6.00 |

| Wealthy Hypio Babies | ETH | 6510.86 | 43 | 1.17207 | 50.40 | 30.14 | 906 | 1.17926 | 1068.41 | 6.09 |

🔍 In-Depth Analysis of Top 5 Projects

1. Courtyard.io — The Ultimate Undervalued Play (PSR 0.35)

Inspired by Benjamin Graham’s principle of “Margin of Safety” from The Intelligent Investor, Courtyard.io demonstrates how utility-driven assets with real transaction volumes can fly under the radar. With over 35K sales this month and a PSR of just 0.35, it exemplifies value investing in Web3.

Graham would be impressed by this one.

2. Azuki Elementals — Anime Culture Meets Real Utility

PSR at 5.78 may not sound ultra-cheap, but compare that to its 7-day trading volume spike and consistent average price. This project balances narrative-driven art with ecosystem strength, echoing Howard Marks’ doctrine:

“You can’t predict. You can prepare.” (The Most Important Thing)

3. Gemesis — A Hidden Builder-Focused Collection

Though not flashy, Gemesis boasts a strong community and steady transactions. It reminds us of the quiet compounders in public markets, often overlooked. Its sub-6 PSR and high sales-to-market-cap ratio make it a worthy hold for long-term investors.

4. Memeland Captainz — Memes with Economic Depth

On the surface it may look like a meme project, but the volume tells a different story. Backed by a strong ecosystem and Memecoin alignment, Captainz shows Web3-native economic design, akin to what Chris Dixon outlines in Read Write Own—”networks reward contributors, not just capital.”

5. Wealthy Hypio Babies — High Avg Price, Reasonable PSR

Despite fewer total sales, this project sustains a premium average price (1.17 ETH) and still keeps a healthy 6.09 PSR. It sits at the edge between collectible luxury and organic growth—a combination often noted in 金融の世界史 as the spark for early asset bubbles.

📈 Visual Insights

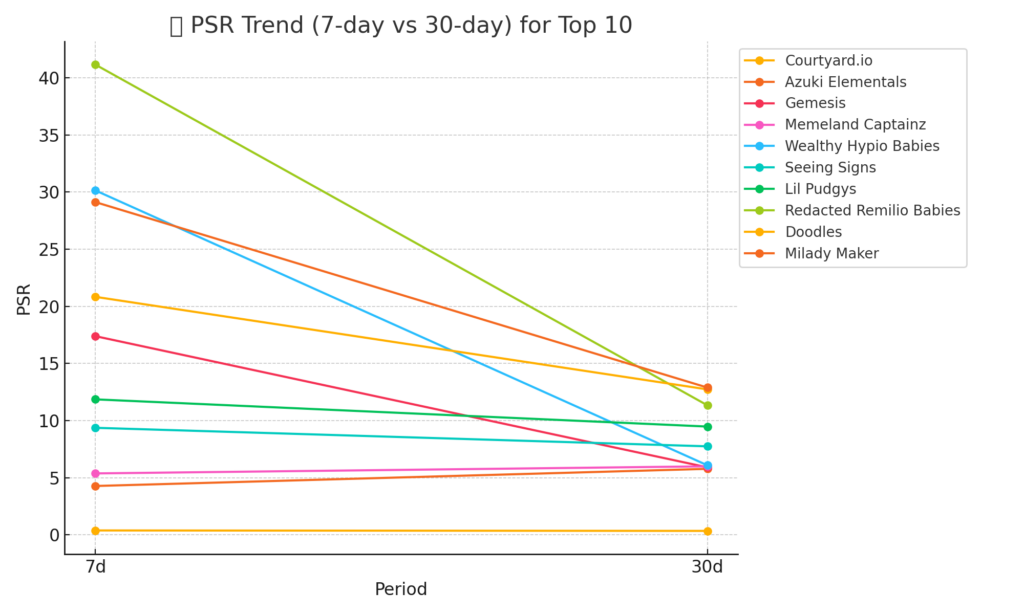

🔹 PSR Trend (7-day vs 30-day) for Top 10

This chart helps identify whether a project’s valuation is stabilizing or diverging from its sales activity. Courtyard.io’s PSR remains ultra-low across both timeframes, signaling sustained undervaluation.

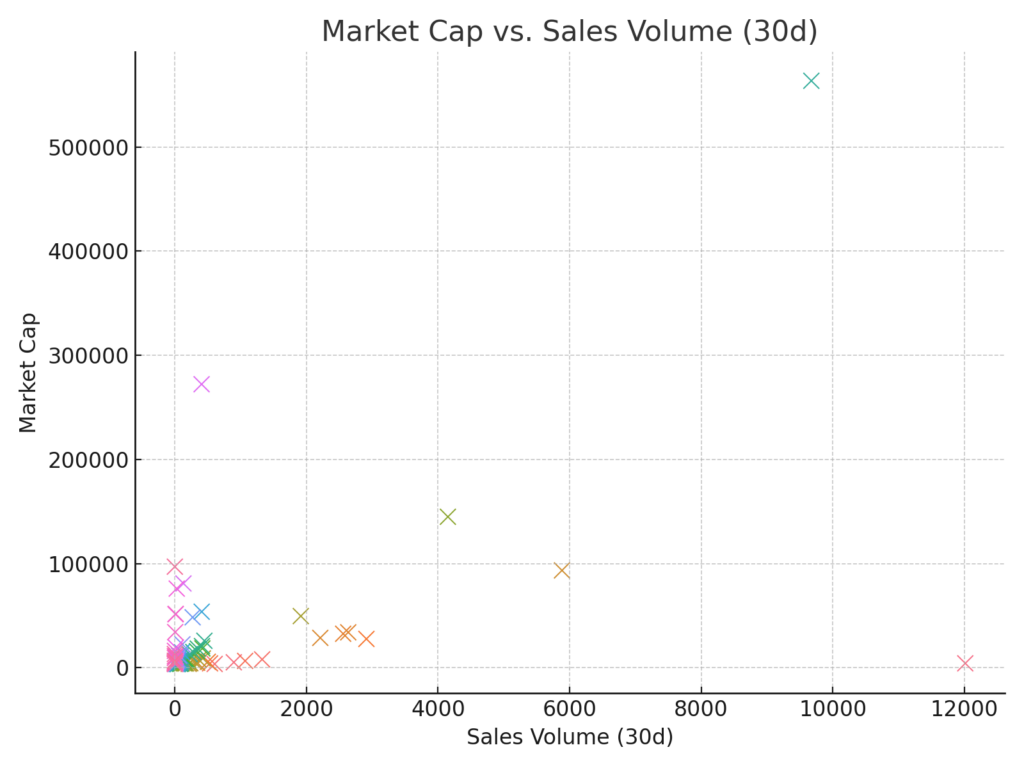

🔹 Market Cap vs. Sales Volume (30d)

Outliers to the bottom-right—like Courtyard—represent ideal targets: high sales volume, low market cap.

🧠 Philosophical Takeaways from Investment Classics

Drawing from investment literature and Web3 thought leaders:

- Graham & Dodd (The Intelligent Investor): “Price is what you pay. Value is what you get.”

→ Courtyard is selling at a discount to its real activity. - Howard Marks (The Most Important Thing): “The biggest investing errors come not from factors that are informational or analytical, but from those that are psychological.”

→ Don’t be fooled by flashier, higher PSR projects. - 板谷敏彦『金融の世界史』: Bubbles always start with legitimate innovation. Follow activity, not hype.

→ Sales > Followers.

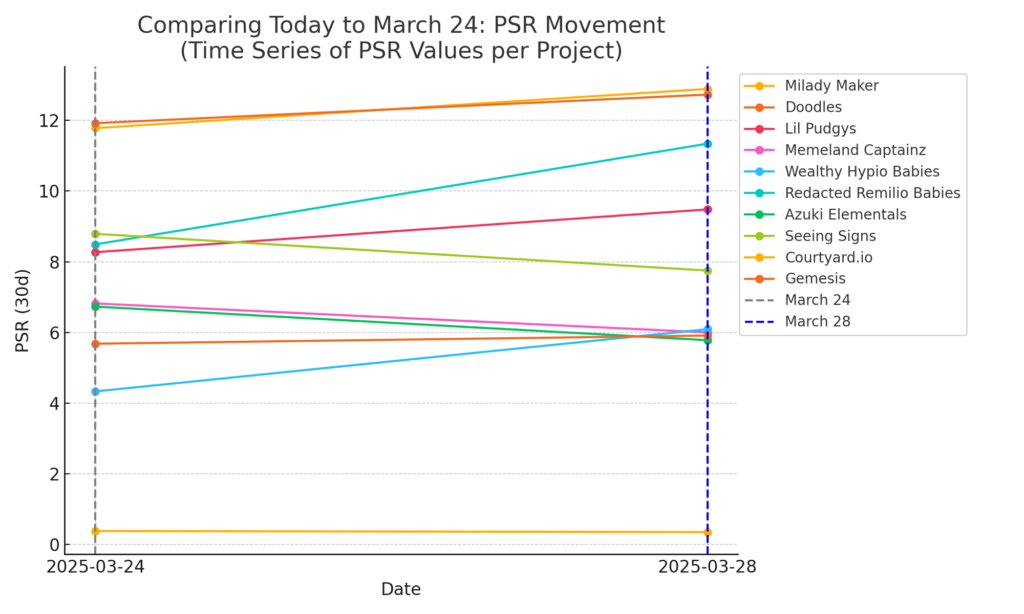

🧭 Comparing Today to March 24: PSR Movement

Coming up next blog update: We’ll visualize the time series of PSR values per project (March 24 vs March 28) to show which ones are becoming cheaper or more expensive over time.

✅ Conclusion: What Should You Do?

If you’re looking to invest smart in NFTs, treat them like equities:

- 📉 Use PSR to identify undervalued assets.

- 📈 Combine quantitative metrics with community strength and narrative.

- 🤝 Join the right ecosystem—where value compounds.

We’ll continue to monitor these projects daily. Follow us to stay ahead.

コメント