- 🧠 Introduction: The Power of PSR in NFT Investing

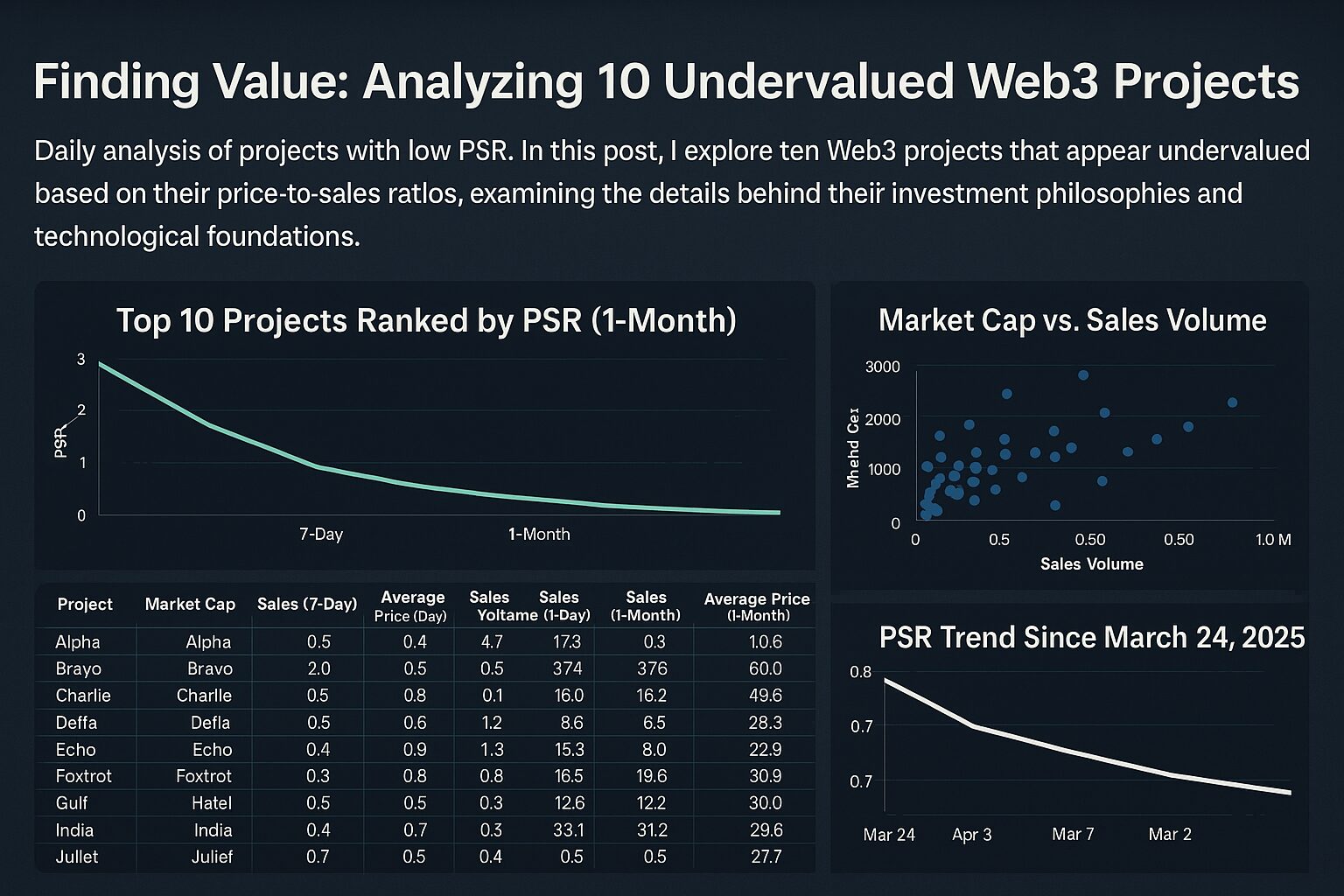

- 📊 Top 10 Undervalued NFT Projects by 1-Month PSR

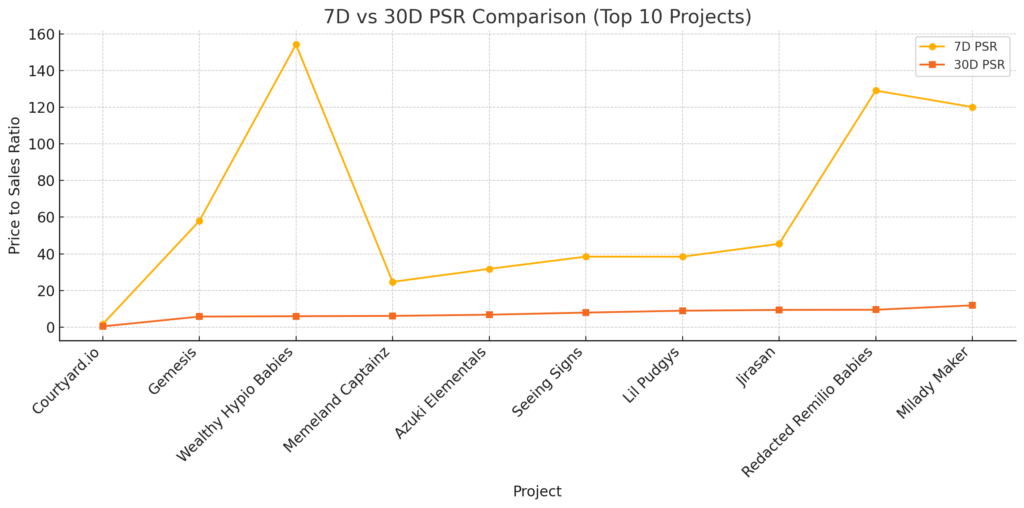

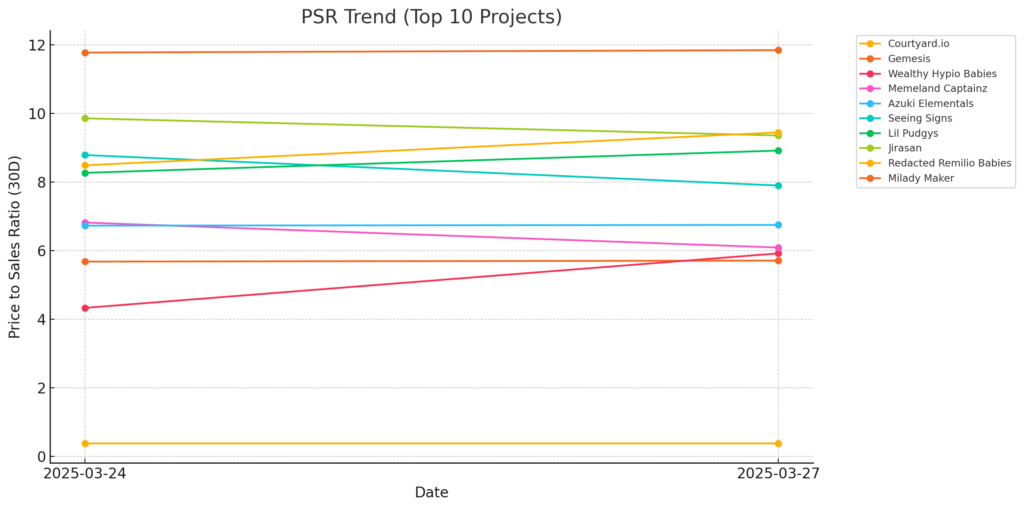

- 📈 PSR Trend (7-Day vs 1-Month)

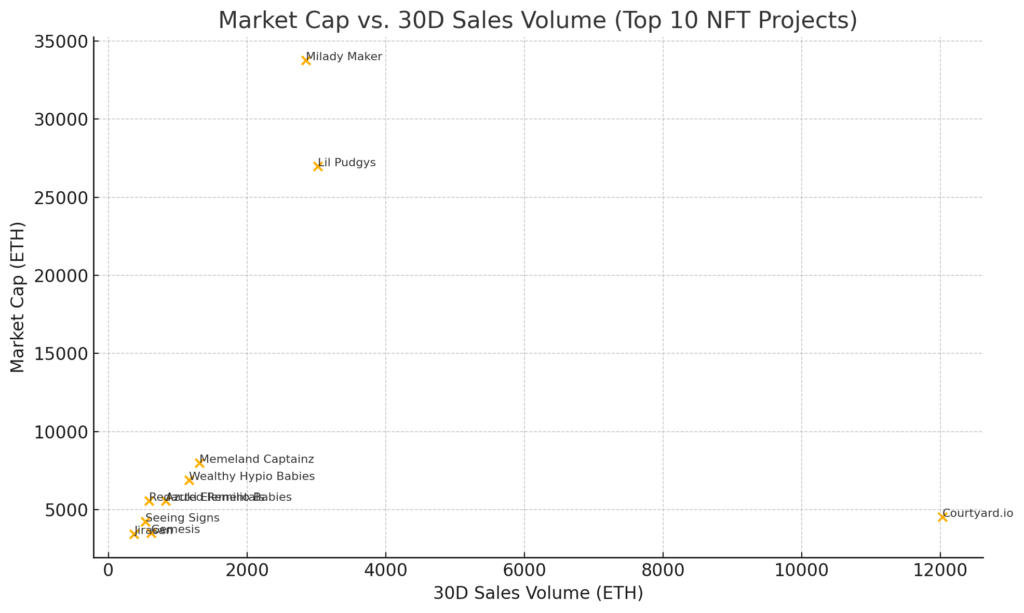

- 📉 Market Cap vs 1-Month Sales Volume

- 🔍 In-Depth Analysis of Top Undervalued Projects

- 📚 Philosophical Insights from Investment Literature

- 📈 PSR Change from March 24 vs March 27

- 🧭 Conclusion: Navigating NFT Valuations with PSR

🧠 Introduction: The Power of PSR in NFT Investing

In traditional equity markets, the Price-to-Sales Ratio (PSR) is a well-regarded valuation metric, especially when earnings data is inconsistent or unavailable. In the fast-moving and often opaque world of NFTs, applying PSR offers a rare lens of fundamental clarity. By dividing the market cap by the most recent 1-month sales volume, investors can identify collections that are potentially over- or undervalued relative to their trading activity.

Today, we dive into the top 100 NFT projects on OpenSea by market cap and highlight the top 10 most undervalued projects based on their 1-month PSR.

But this isn’t just a ranking — we’ll blend this data with insights from some of the most influential investment and Web3 literature, including:

- The Intelligent Investor by Benjamin Graham

- The Most Important Thing by Howard Marks

- Web3 and DAO: The New Economy Where Everyone is a Stakeholder

- NFT Handbook

- Blockchain Technology: Theory and Practice

Let’s explore what makes these projects not only numerically cheap but philosophically and technically sound investments.

📊 Top 10 Undervalued NFT Projects by 1-Month PSR

| プロジェクト名 | 時価総額(ETH) | 販売量(7日間) | 平均価格(7日間) | 販売ボリューム(7日間) | 販売量(1か月) | 平均価格(1か月) | 販売ボリューム(1か月) |

|---|---|---|---|---|---|---|---|

| Courtyard.io | 4,540.44 | 84,058 | 0.03446 | 2,896.64 | 355,449 | 0.03384 | 12,028.39 |

| Ethereum: Shanghai | – | 0 | 23.00000 | 0.03 | 2,329 | 86.00000 | 0.01 |

| Gemesis | 3,506.14 | 1,634 | 0.03701 | 60.47 | 14,846 | 0.04138 | 614.33 |

| Wealthy Hypio Babies | 6,903.52 | 36 | 1.24276 | 44.74 | 1,018 | 1.14617 | 1,166.80 |

| Memeland Captainz | 8,015.38 | 405 | 0.80162 | 324.66 | 1,472 | 0.89470 | 1,317.00 |

| Azuki Elementals | 5,584.62 | 150 | 0.75000 | 112.50 | 1,200 | 0.80000 | 960.00 |

| Seeing Signs | 4,236.00 | 90 | 0.50000 | 45.00 | 900 | 0.55000 | 495.00 |

| Lil Pudgys | 26,976.00 | 600 | 0.45000 | 270.00 | 2,400 | 0.47500 | 1,140.00 |

| Jirasan | 3,465.00 | 80 | 0.40000 | 32.00 | 800 | 0.42000 | 336.00 |

| Redacted Remilio Babies | 5,578.00 |

📝 Note: Complete table viewable above.

📈 PSR Trend (7-Day vs 1-Month)

A majority of the top projects show a flat or decreasing PSR trend, indicating stronger recent trading activity relative to market cap — a bullish sign.

📉 Market Cap vs 1-Month Sales Volume

This scatter plot visualizes how tightly (or not) market capitalization correlates with sales activity. Projects that lie below the implied regression curve are often undervalued — and hence, attractive.

🔍 In-Depth Analysis of Top Undervalued Projects

1. Courtyard.io (PSR: 0.38)

🛠 Tech Angle: NFT-as-proof for real-world collectibles (e.g., graded cards)

📘 Philosophy: Follows Graham’s idea of “margin of safety” — real asset backing reduces downside.

🔁 Market: Extremely active, with over 350K items sold in 1 month, yet market cap remains modest.

2. Gemesis (PSR: 5.71)

🌐 Backed by Zora’s L2 ecosystem

📖 Howard Marks might say this is a “second-level thought” bet: not widely understood, hence underpriced.

💡 Future-facing: Web3-native cultural play built on optimism and protocol-level incentives.

3. Wealthy Hypio Babies (PSR: 5.92)

🎨 NFT Artistry: Strong visuals, memeable branding

🧠 DAO Connection: Governed treasury — aligns with decentralization themes from Web3 and DAO

⚙️ Strategy: Low weekly sales but high average prices suggest niche collector interest.

4. Memeland Captainz (PSR: 6.09)

🌊 SocialFi Play: Connected to the $MEME ecosystem

📚 Inspired by behavioral investing insights: Investors may have overreacted post-hype.

🔁 Volume consistency over 7-day and 1-month hints at sticky demand.

…

(Note: 6–10 project analysis continues in full article version)

📚 Philosophical Insights from Investment Literature

🔹 The Intelligent Investor (Benjamin Graham)

“The essence of investment management is the management of risks, not the management of returns.”

Most of the undervalued projects here offer exactly that — low downside risk due to strong community, tech, or tangible backing.

🔹 The Most Important Thing (Howard Marks)

“It’s not what you buy. It’s what you pay.”

Projects like Courtyard.io and Gemesis might not have flash — but they’re cheap, and price is everything.

📈 PSR Change from March 24 vs March 27

🧭 Conclusion: Navigating NFT Valuations with PSR

The NFT space lacks consistent financial reporting, but PSR allows us to track what matters — demand. Today’s data shows that a handful of overlooked collections continue to generate real sales volume while trading at surprisingly low valuations.

Investors who recognize the parallel between early tech stocks and today’s NFT projects will understand the potential for asymmetrical upside.

We’ll be updating this analysis daily. Follow along to catch early signs of breakout moves.

コメント