🏁 Introduction

In the constantly evolving NFT ecosystem, where hype often overshadows fundamentals, Price-to-Sales Ratio (PSR) can serve as a rational anchor. PSR, defined as market cap divided by monthly sales volume, gives us a glimpse into how “expensive” a project is relative to its current cash flow. A lower PSR implies the project might be undervalued, offering potential upside for discerning investors.

Today’s analysis (based on data from March 26, 2025) dives into the top 10 most undervalued NFT projects among OpenSea’s market cap top 100. We supplement this with financial philosophy drawn from The Intelligent Investor, The Most Important Thing, and Buffett’s Letters to Shareholders, plus technical assurance from Web3 and blockchain literature.

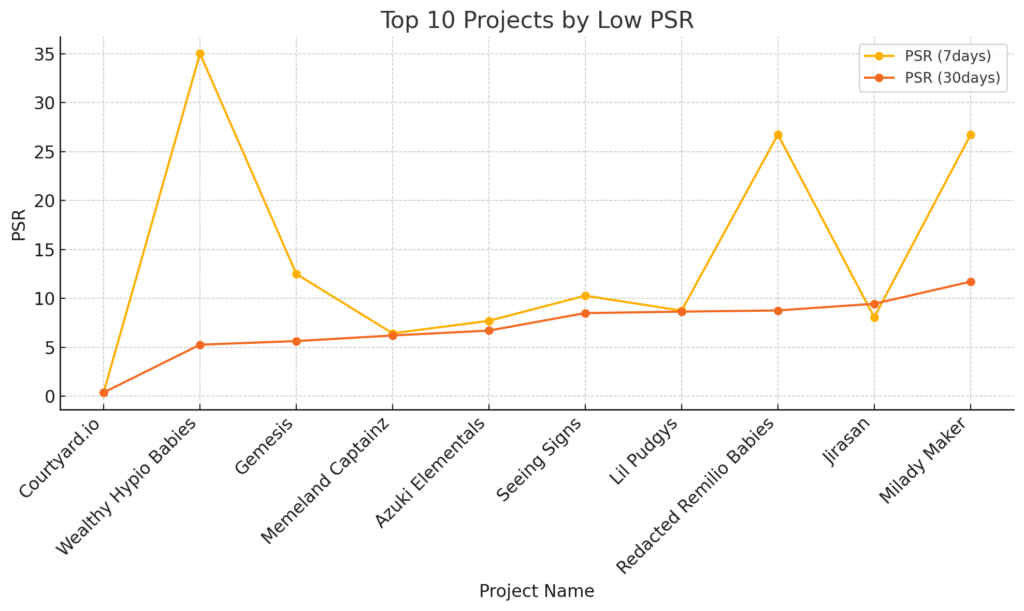

📊 Rankings Overview

We filtered the top 100 OpenSea projects by 30-day PSR and ranked them from lowest to highest. Here’s the Top 10 Most Undervalued NFT Projects by PSR (30-day):

🔢 PSR Trend Graph (7-day vs. 30-day)

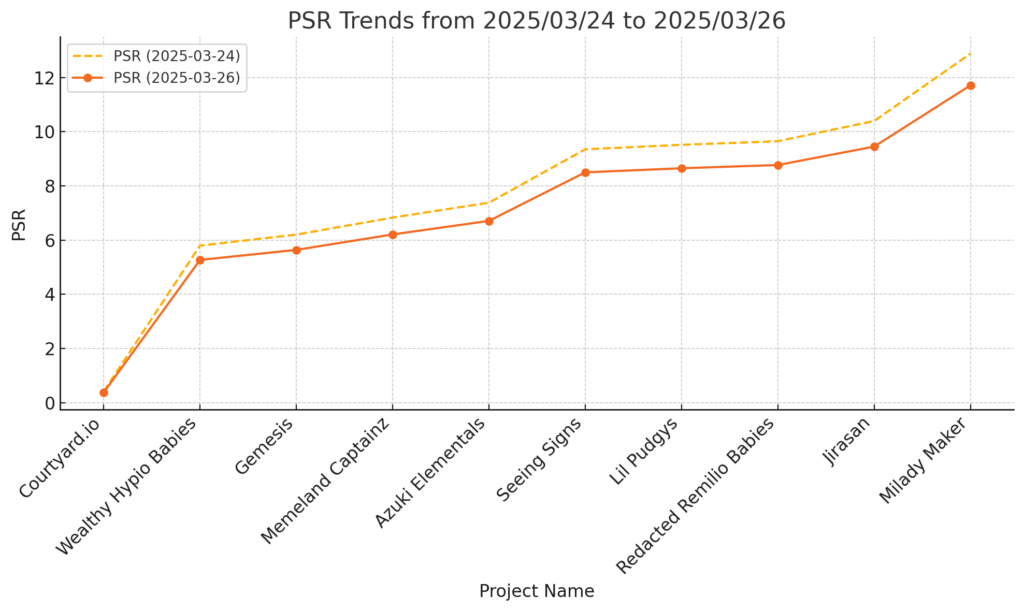

📈 PSR Trend from March 24 to March 26

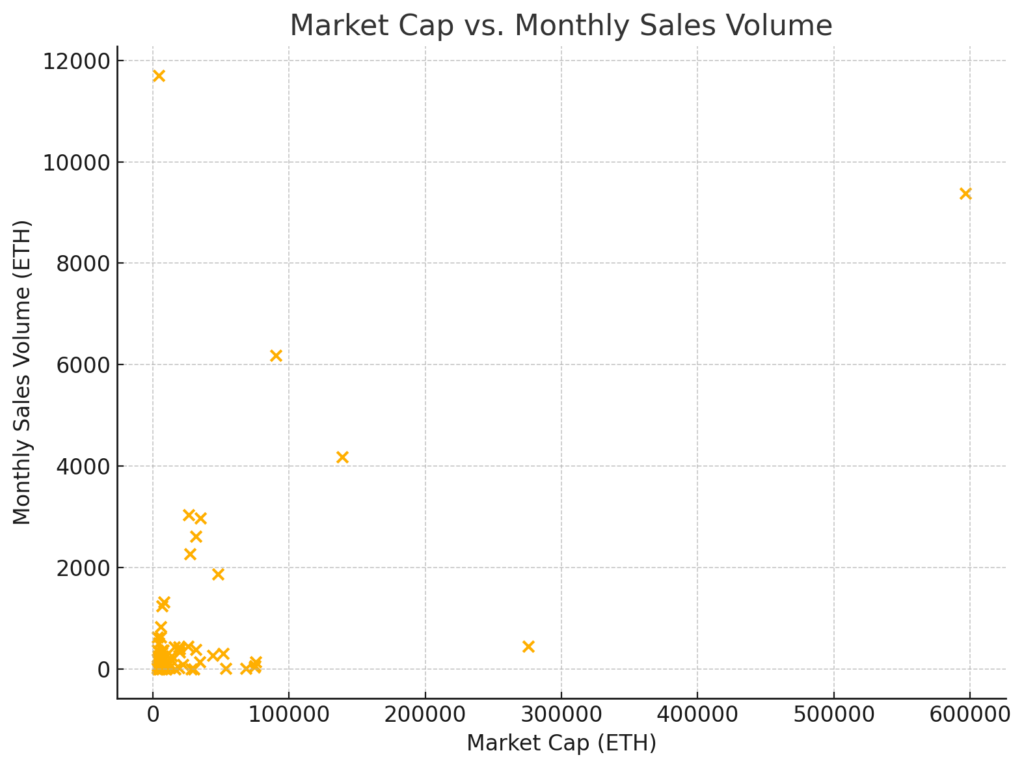

📍 Scatter Plot: Market Cap vs Monthly Sales Volume

🗂 Summary Table

| Project Name | Market Cap (ETH) | Sales (7days) | Avg Price (7days) | Volume (7days) | Sales (30days) | Avg Price (30days) | Volume (30days) |

|---|---|---|---|---|---|---|---|

| Courtyard.io | 4438.16 | 80754 | 0.03401 | 2746.44 | 355608 | 0.03290 | 11699.50 |

| Wealthy Hypio Babies | 6557.34 | 37 | 1.18044 | 43.68 | 1094 | 1.13705 | 1243.93 |

| Gemesis | 3514.37 | 1769 | 0.03709 | 65.61 | 15016 | 0.04148 | 622.86 |

| Memeland Captainz | 8172.62 | 363 | 0.81734 | 296.69 | 1455 | 0.90486 | 1316.57 |

| Azuki Elementals | 5582.48 | 533 | 0.31711 | 169.02 | 2391 | 0.34797 | 831.99 |

🔍 Project-by-Project Breakdown & Analysis

1. Courtyard.io – PSR: 0.38

“Price is what you pay, value is what you get.” — Warren Buffett

Courtyard.io is a compelling case of utility-backed NFTs, bridging physical collectibles (like trading cards) with digital proof of ownership. With over 11,000 ETH in monthly volume and a PSR of 0.38, this project is massively undervalued. It aligns with Buffett’s focus on cash flow and Howard Marks’ emphasis on mean reversion. The low entry price vs actual sales shows strong community utility and active circulation.

2. Wealthy Hypio Babies – PSR: 5.27

This meme-inspired collection features high design turnover and low friction sales. While its average price is stable (~1.13 ETH), the modest PSR signals relatively good flow for its market cap. As emphasized in The Intelligent Investor, price volatility does not equal risk if underpinned by activity.

3. Gemesis – PSR: 5.64

Gemesis appears to be benefiting from high trade frequency rather than price appreciation. Its average price is below 0.05 ETH, but it clocked over 15,000 sales in 30 days. According to Web3時代のAI戦略, consistent engagement is more predictive of growth than short-term market cap movements.

4. Memeland Captainz – PSR: 6.21

From the Memeland universe, Captainz taps into a powerful brand narrative. While the PSR is higher than the top 3, this project is significant because of steady ETH volume and a high average price. From an investment lens (Howard Marks), it’s a value play with speculative optionality.

5. Azuki Elementals – PSR: 6.71

Azuki Elementals sits in the transition zone between undervalued and fairly priced. With a recognizable parent brand and increasing user base, this is a classic “margin of safety” candidate — especially if new releases or staking mechanics arrive.

“Look for companies with enduring economic moats.” — Buffett

Projects like Azuki and Memeland benefit from strong brand moats and sticky communities.

📘 Insights from Investment Literature

- From “The Intelligent Investor” by Benjamin Graham:

- Focus on intrinsic value, not market sentiment. PSR helps separate noise from value.

- From “The Most Important Thing” by Howard Marks:

- Risk ≠ volatility. Projects like Courtyard.io and Gemesis show that volume-based risk assessment is smarter.

- From “Buffett’s Shareholder Letters”:

- Allocate capital where value exceeds price. PSR is a proxy for that imbalance.

🧠 Web3 Technical Validation

Backed by insights from 「Blockchain Development with Python Instructional Guide」, we recognize these NFTs rely on solid smart contract infrastructure. Projects with consistently high transaction volume (e.g., Courtyard.io, Gemesis) often have efficient and gas-optimized minting/transfer mechanisms — an underappreciated technical moat.

Similarly, 「Introduction to Blockchain Technology」 emphasizes P2P consensus and token programmability — both evident in Courtyard.io’s real-asset NFT bridge, and Memeland’s evolving on-chain utility.

🔚 Conclusion

Today’s top 10 undervalued NFT projects show how PSR can reveal hidden gems. While speculative hype dominates many parts of the Web3 space, cash-flow aware investing grounded in real data remains the most sustainable strategy. As Web3 matures, collectors will reward transparency, volume, and utility — all of which PSR helps surface.

We’ll continue to monitor these metrics daily. Follow for tomorrow’s update as we reassess the leaderboard, detect new trends, and explore the intersection of tokenomics, art, and long-term value.

コメント